Most people believe that banks safeguarded their deposits in their vaults and maintain a liquidity ratio on or about 100%. In other words, banks only lend out the money which they had on deposits. However, today’s banking system reality is far different, posing a great risk for all economies going forward.

What is a Fractional Reserve System?

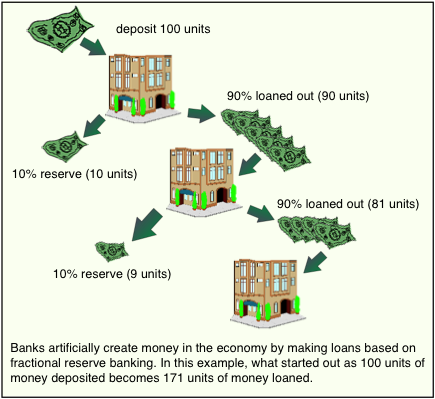

‘Fractional reserve banking’ allows banks to keep only a fraction of their deposits while lending out the rest with interest to other clients. Banks are therefore capable of loaning out money which they do not in fact possess. The assumption, of course, is that people will not all withdraw their funds from the banking system at the same time. In the US, a bank deposit of 1000$, 900$ or 90%–is lent out: 100$ is kept in reserve, and $900 is released into the market in the form of a loan. The beauty of this system is that the money lent out will most probably be brought back to the bank in the form of a deposit by either the borrower himself or by someone who has received his money in payment. This theoretical 900$, registered as a deposit, is now ready to be divided: 90$ (or 10%) will be kept in reserve, and 810$ (or 90%) will be lent out again. Money has just been created!

This situation gets even worse in some countries, for instance Canada and Australia have a 0% reserve requirement, thus banks in these countries among others have the ability to create virtually an unlimited amount of money.

This situation gets even worse in some countries, for instance Canada and Australia have a 0% reserve requirement, thus banks in these countries among others have the ability to create virtually an unlimited amount of money.

This phantom money that is loaned out is created out of thin air, phantom money for which in turn banks charge a rate of interest to its borrowers. When money is created, debt is created!

The problem with this system is that since more loans (credit) are created than actually deposits (money), it creates an environment where credit becomes significantly more important than money. Every time a loan is created by a bank, the credit supply expands. According to the FED’s Total Credit Market Debt Owed”, is approximately 53$ trillion and 2.4$ trillion in the true money supply (M1). In other words, cash money is approximately 4.5% of credit (TCMD/M1).

The result to our economy is that boom periods are hardly driven by cash money, as cash money is insignificant in relation to credit. Credit is what drives the markets, and it is this same credit that busts the markets as well (in times of credit contraction).

To increase economic activity in a country operating in this type of system, you need to increase the level of credit and thus debt grows as a consequence. Although, this is self serving, due to the fact that if debt is the “fuel” to increase economic activity, interest payments become larger and larger, and eventually reaches a point where debt can no longer be increased. This point is known as the minsky moment.

However, even though central banks around the world are printing money out of thin air (FED,BOE,ECB,BOJ,PBOC) and increasing the level of debt in their respective countries, most of the credit money creation is done at the bank level. Every time, someone applies at a bank for a mortgage, this money received was created out of thin air as well and expands the money supply.

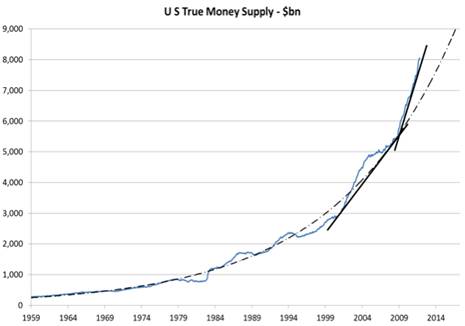

Here is a typical graph of what the money supply looks like in the US. Note that the “hockey stick” formation is similar to most advanced economic countries. As stated above, our economy is addicted to credit, and the only way to increase economic activity is to increase this exponetial money supply vertically higher. Althought, this is mateactically impossible for it to continue forever. We live in a world bounded by physical restriction “finite oil”, resources etc… More money entering into the system chasing a limited supply of goods creates inflation and eventual lower standard of living.

How does Fractional Reserve Banking affect your life?

In the 60’s and 70’s, one person working in a household in North America was sufficient to support a familly. Now, it sometimes take more than two people to support a familly. By definition, an increase of the money supply is inflation. Inflation has robbed the purchasing power of your hard earned money covertly. How was this done? wages have not increased at the same pace as inflation. The CPI index that measures inflation, has been adjusted over the years to dampen its effect (this has been done using hedonics and substitutions). Shadow Stats, measures inflation amoung other stats as they were previously reported.

This can also affect your life depending on how you play the credit game. During times of economic credit creation, everyone feels the effects of a stimulated economy. Times are good and most people pile on debt to purchase luxury items. This can go on for an extended period of time, but not indefinitely: as costs for instance Real-Estate go up due to a distorted supply-demand fundamentals, and people must assume increasingly more debt over time. As mentioned in “Canada Housing Bubble – part 2” Home prices in Canada are overvalued in terms of historical income/debt averages. Instead, our lives revolve around a credit rollercoster due to Fractional Reserve lending.

Further aggravating the problem are homeowners who use the equity of their homes to pile on more debt. Although some may use this money in constructive ways (i.e. purchasing strategic income properties), the fact remains that most will not. Some will use the newly created money from the credit creation cycle on consumption. It is these individuals who create the malinvestments in an economy, and eventually pop the credit cycle from expanding. When defaults occur, credit disappears from thin air, just as it was created. In a normal free-market economy, interest rates at banks would rise to provide incentive for people to save money and expand bank reserves to once again increase lending. However, we no longer live in a free-market and as a world society we are addicted to the “high” of a credit cycle. Governments have adopted low interest policies and intervene in the market to artificially suppress interest rates to keep the credit boom alive. This addiction further undermines the economy through interest rates that have been kept low instead of being left to rise as dictated by the market.

In the end, if you are a good swimmer and manage to stay afloat during the economic credit tides, you should perform very well: the accumulation of wealth created during the booms will be transferred to you once the malinvestments and defaults are allowed to play out. If positioned properly, one can accumulate great wealth from the coming real economic collapse – When credit ceases to expand.

A great video of this situation is explained by Professor Albert Barlett in his presentation Arithetic, Population and Energy. Also Chris Marentson in his crash course. Both Documentaries can be found in our “truth” documentary library here

Post your thoughts below.