The paper price for silver appears to be retesting its April low of $22.09. However, when the silver price reached this price back in mid-April, the physical price was approximately $25 USD/oz for about a day until physical demand dried up all the supply in the market–which consequently drove up the premiums back to $28/oz. Right now, with spot price at $22.60, the physical price is at $26.97/oz or a $4.37/oz premium over-spot. Long term trends for gold and silver are still intact. Spot price could still go lower in the short term, however, the physical may not allow it. Silver mining companies will not produce silver if they cannot make it profitable, thus reducing the supply even further. This is a rare moment to pick up silver at $26-27.

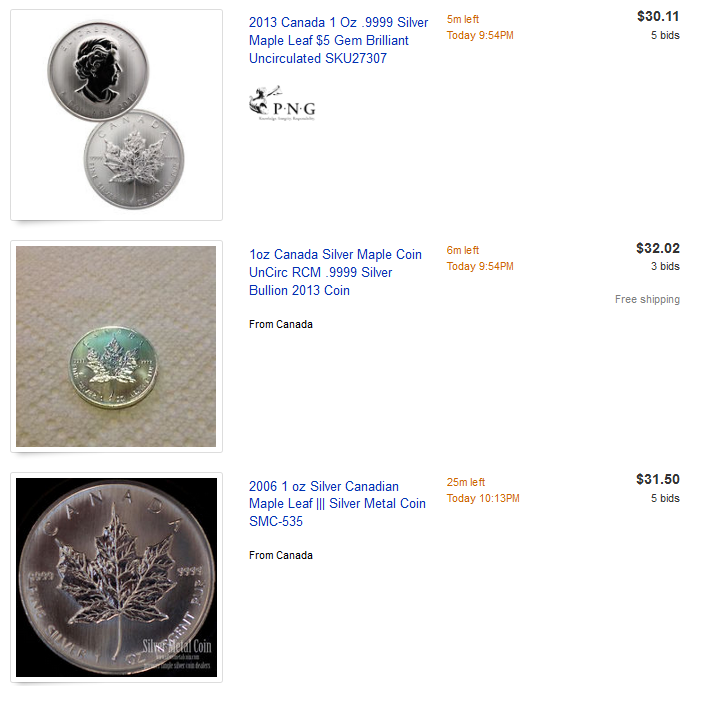

Once again, Kitco has no more bullion bars on their shelves at the moment. Silver maples are still being sold on Ebay for over $30 (that is, for a 37% premium over the spot price)! Or is it possible that there is starting to be a disconnect in the paper price to the physical market?

A Run on the Bullion Exchanges

Here’s the details you should know about the paper and physical markets. To shed some light on what is exactly happening to the prices of silver and gold.

Andrew McGuire, a former Goldman Sachs trader, disclosed that the London bullion Market Association (LBMA) trades on a net basis each year of $5.4 trillion dollars, a little less than half the size of the US economy. The LBMA is the biggest gold commodity market in the world.

But how can the LBMA do this when the gold market is so tiny? The world production of gold is about 2,500 metric tons of gold (88,184,905 oz) which at today’s price of $1,667 is approximately $147 billion in yearly production value.

The LBMA is the equivalent of a fractional reserve system in that it is leveraged 100 to 1. For every ounce of real gold that is sold, 100 ounces of paper gold is sold, meaning there are 100 claims on each and every ounce of gold. These numbers were verified by Jeffrey Christian, a gold expert and founder of CMP Group (a commodities research, consulting, investment banking, and asset management company). The leverage is absurd.

The LBMA can be compared with other exchanges. The world’s gold market is backed up by approximately 2.3% of real gold. If a mere 2.5% of people would start demanding their gold, the physical gold market would explode, subsequently crushing the dollar, as the value of the dollar is inversely proportional to the price of gold.

Hedge fund manager Kyle Bass pointed out that the New York Comex has only approximately 3% of the bullion on hand to cover future contracts positions. and this game will continue if people do not demand delivery of their gold. The emperor has no clothes!

I know the emperor has no clothes and that’s why I invest in the real thing. I use Sprott Money whenever I buy gold or silver bullion. They offer competitive pricing on their products, quick shipping, and the reputation of Canada’s financial guru Eric Sprott. Be sure to check them out!