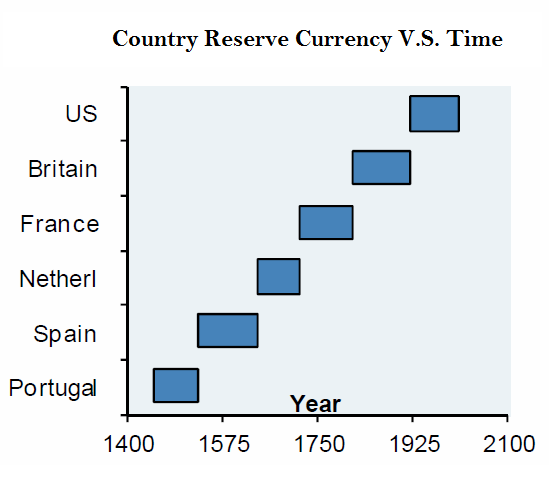

A reserve currency has never lasted forever and the US Dollar is no exception, especially considering its seriously grave trade and debt imbalances. A country can only go so far with its imbalances, and today the US is the largest debtor nation in the history of the world. The fate of the US surely lies on its creditors, who also produce what the US consumes. China, Japan and OPEC countries are the main holders of the US debt. However, the US Fed also stepped in to purchase US debt as a lender of last resort to prevent a further banking crisis. Yet, anyone who uses their “credit card” to finance their debt is doomed to fail, even if this someone is the US government. Who will emerge as the superpower currency after the fall of the US dollar?

Today, the US Dollar is the reserve currency of the world. You need it, for instance, to buy oil, a vital component of any economy. Since other countries like China cannot print US dollars at their leisure, they have to get it from somewhere. They get it from trade with the US. The US buys products in Asia and the rest of the world with US dollars, and in turn these same dollar surpluses are used to buy oil and US bonds, creating a much needed artificial demand for US dollars.

A major issue with being the reserve currency is the “Triffin dilemma“ which was first introduced by Robert Triffin in the 1960’s, who pointed out that the country that holds the reserve currency must be willing to supply the world with an extra supply of its currency which naturally creates a trade deficit. This is exactly the dilemma that the US is facing today. A trade deficit can be a long-term problem, as foreigners must finance the perpetual debt. As of 2011, the US had a trade deficit of $558 billion, and that number is growing. Some have even argued that the trade deficit accounted for 50% of the overall US national debt.

The US government allows for the debt to continue to grow by adding new debt on top of old debt plus compounded interest. Instead of paying back the debt, the government just borrows more to cover previous interest. The interest payments on the debt is over $1 billion a day, operating on annual trillion dollar deficits, all of which is clearly unsustainable.

Who are the main contenders for the New Reserve Currency?

The Chinese Yuan and the SDR. The Euro is a far third, with much of the same problems as the US dollar.

As I pointed out in a previous article, if the IMF and the G20 do not come up with a solution with their SDR currency to replace the US dollar, the Chinese will. And right now there is a race for the new reserve currency title. Both are getting ready.

Here are the stats for each currency;

SDR in the blue corner, weighing in at 1.04 UK Pounds

-Created in 1961 by the IMF. (which is largely controlled by the US);

-The SDR is an interest-bearing “international asset;”

-Can be converted to the Pound, Euro, and Yen Dollar;

-Not traded on any exchanges;

-Its value is determined by a basket of currencies (the ones mentioned above);

-14 countries used to peg their currency to the SDR, but today only one does (the Syrian pound);

-$204.1 billion in circulation among its members (proportioned to the size of their economies);

-Cannot be used to purchase goods and services directly–only trade among member nations;

-Most developed countries have SDR’s as part of their Forex reserves in their respective central banks;

-Used in international law: for instance, the Montreal Convention adopted the SDR. This new valuation is used to determine benefits for families for death, injury and baggage liability while on board an aircraft (see United Airlines baggage liability);

-The African Development Bank, Arab Monetary Fund, Asian Development Bank, Bank for International Settlements, Common Fund for Commodities, East African Development Bank, Economic Community of West African States, International Center for Settlement of Investment Disputes, International Fund for Agricultural Development, and Islamic Development Bank all report using the SDR as a unit of account;

-Reported gold in reserves (2,814 metric tons);

-The SDR can be a way around the “Triffen dilemma.”

Chinese Yuan in the red corner, weighting in at 0.1 UK Pounds

-Legal tender money in China, 2nd largest economy in the world;

-Has appreciated over 100% against the USD since 1989;

-Future’s are traded on the Chicago Mercantile exchange and RMB denominated bonds exist;

-Can be technically converted to any currency;

-Generally accepted for payments for goods and services throughout much of Asia;

-China has initiated various pilot projects to “internationalize” its currency;

-Since 2005, the Chinese Yuan exchange rate has been allowed to float in a narrow margin around a fixed base to a basket of currencies;

-$5.47 trillion in cash in circulation;

-Bi-lateral trade agreements have been or are in the process of setting up trade in the Chinese Yuan. See below.

- China and Germany (See Here)

- China and Russia (See Here)

- China and Brazil (See Here)

- China and Australia (See Here)

- China and Japan (See Here)

- China and Chile (See Here)

- China and the United Arab Emirates (See Here)

- China, Brazil, Russia, India and South Africa (See Here)

- China and Iran (See Here)

-Reported gold in reserves (1,054.1 metric tonnes);

-China is the largest producer of gold and on track to became the largest importer;

-Some central banks (Nigeria, Iran, Chile, Venezuela etc.) are selling their USD Forex reserves and buying the Yuan;

-May shift the trade imbalances on to China if the Yuan is the new reserve currency.

Who will take the title of the new reserve currency?

As mentioned above, the SDR is controlled indirectly by the US through their voting powers: they have 17% nominal interest, and there is a required 85% majority for decisions to pass. Their approach to implementing the SDR as reserve currency is much more engineered than the Yuan’s, which is resulting out of competition and choice. The US is forcing their way to became leader, however they are facing much resistance from the underdog Chinese ‘boxer’ who is getting the support from the crowds. The grass roots movement for the Chinese Yuan to became the reserve currency is becoming ever so clear, with all the bi-lateral trade agreements and international finance arrangements. Remember, a currency is only “money” if people accept it as money. Although the Yuan might not have the weight of the SDR, it surely has support and acceptance from many countries.

The next question remains, how will this transition affect gold? This will be answered in my next post. Stay tuned.

References

-http://www.globaltimes.cn/content/754984.shtml

-http://www.imf.org/external/np/exr/facts/gold.htm

-http://en.wikipedia.org/wiki/Renminbi

-http://en.wikipedia.org/wiki/Gold_mining_in_China