During the Middle Ages, the gold supply entering into the market was very limited. For instance, as most of the gold mined was used for the Church or State. This caused money to grow at very slow pace and this restrained economic activity from going beyond its threshold. People had products or services for exchange, however, there was not enough gold in circulation to facilitate daily transactions. A society can not prosper if there is no money to exchange for goods and services. This is much of the same problem small businesses and individuals are facing today, access to credit. Self-issued credit can be an alternative approach to the liquidity restraints, instead of going deeper into unsustainable levels of debt. As I pointed out in a previous article the US government is growing it’s debt at about 10Million a minute.

Who Creates Self-Issued Credit?

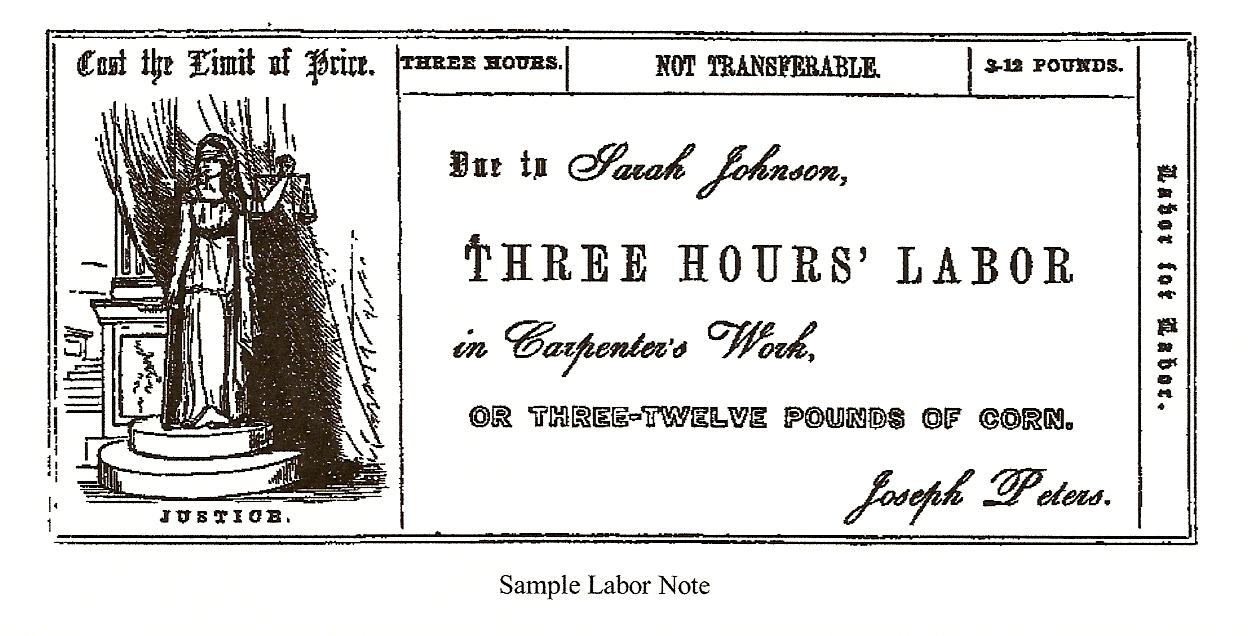

Traditionally, one might think that money is created by central banks or monarchs and not people. This is a fallacy, money does not have to be created or controlled by banks or monarchs. Self-issued credit during the Middle Ages was issued by anyone who produced a good or provided a service as backing for their money. In other words, self issued credit represents the goods and services in a market. The only purpose gold and silver served in this system was to provide an understood measure of value, for instance a yard stick to measure length.

The shortage of gold in the Middle Ages lead to the issuance of these “Self issued Credit” all around the world. This system worked very well alongside with Gold and Silver money. However, it is very seldom spoken about.

What Happens if There Too Much Supply of These Credit Notes?

This self-issued credit was used as money and it was accepted based on the reputation of the owner. If he or she had a good reputation, then the credit note was widely accepted by anyone. Trust is key in this system. Under this type of system, it would essentially empower every individual to create their own money and hence create competition in currencies. If for example, a producer created more notes than what he can produce or provide as a service, his reputation would suffer and the value of the credit would decrease.

Can Anyone Really Create Self Issued Credit?

A typical medieval market would involve trading with notes issued by bakers, butchers and farmers. In essence, the primary producers issued credit notes and would be usually transferable to anyone since people needed to buy their products all the time. However, a carpenter can issue credit as well, but the value of exchange to other people would probably be worthless as people would assume his credit notes as risky. During the Middle Ages promises issued from one source could circulate through many pairs of hands before returning to their issuer for redemption, providing a supply of money even for people who didn’t intend to redeem them. As confidence grows in this system, self-issued credit becomes money.

In reality it is not much different than Canadian Tire money. A department retailer store where you can buy almost anything in Canada. Everytime you purchase a product at Canadian Tire store, you receive and amount of the producers money based on how much you spend (much like a rewards program). Although, this rewards program gives you cash that you can spend at their stores only. If we were able to use this as money for a medium of exchange, if could provide some of the needed liquidity. And since this money is backed up with the products everyone needs at Canadian Tire, there is intrinsic value. Other major producers can do the same, and this will create an enviroment with competing currencies as money.

However, you might say that these bills are subject to counterfeit, that is true. However, there are digital currencies and digital market places for self issued credit. For instance, Bitcoin a digital P2P digital currency. There are also market places and other businesses heading into this direction. (Canadian Barter System, U-Exchange, International Monetary Systems)

However, you might say that these bills are subject to counterfeit, that is true. However, there are digital currencies and digital market places for self issued credit. For instance, Bitcoin a digital P2P digital currency. There are also market places and other businesses heading into this direction. (Canadian Barter System, U-Exchange, International Monetary Systems)

Source: Canadian Tire

There are also many more online digital currencies that are available, some are even backed by gold. i.e Gold Money.

What Are The Risks With Self Issued Credit?

From the description above, one may say that self-issued credit sounds risky, since this system is heavily dependent on trust. The reputation of the producer is key for its functioning and determines the amount of supply and demand for his credit (money). This system is not much different than the current one. Today’s money is fiat and we trust our central banks and politicians not to abuse it. In other words, we collectively put trust into a system where if the currency is mismanaged, everyone will suffer as a whole. Instead, self-issued credit is more on an individual basis, therefore, creating less moral hazard and more transparency. If one producer with self issued credit abuses his money supply then the whole market will not be affected, the problem is contained and creates a resilient economy through diversity. Competition in any market is healthy, if self-issued credit were allowed then it would create competition among todays currency, forcing it to be restrained from reckless fiscal and monetary policies that are being used today.

One way to help reduce risk of exposure of this self-issued credit is to enforce an expiry date on the credit note. This way the producer can have a control of the outstanding credit notes in circulation. In essence, it is much like a voucher.

How Can It Solve Today’s Debt Crisis?

The problem with today’s Fractional Reserve Banking system is that it creates exponentially more loans (credit) than actually deposits (money), it creates an environment where credit becomes significantly more important than money. Every time a loan is created by a bank, the credit supply expands. According to the FED’s Total Credit Market Debt Owed”, its approximately 53$ trillion and 2.4$ trillion in the true money supply (M1). In other words, hard money is approximately 4.5% of credit (TCMD/M1). Hard money in circulation is insignificant to the amount of credit. The result to our economy is that boom periods are hardly driven by true money. Credit is what drives the markets, and it is this same credit that busts the markets as well (in times of credit contraction).

If we wanted to go down the path using the same current system we have no choice but to experience a depression to liquidate the malinvestments and start new. However, that does not have to happen where we can provide an alternative currency in our system where it empowers the real producers of society to create money based on their reputation to serve the consumer. This new found money will create competition for our current system and provide the much needed liquidity people are needing to continue their business. The best part of self-issued credit is that it is not debt based like our current money. Transaction create potential liabilities, debts are erased when credit is brought back to the producer, it is a promise to deliver at a future date. In other words, this system does not use usury like our current one to enslave people to work harder to pay for their bills. Self-issued credit can be used to temporarily relief the liquidity crisis and to pay down the debt to more sustainable levels.

If you haven’t watched the “Money as Debt” series, or the “The Money Fix” I encourage you to watch during your free time as it would provide you with more specific details on our current system and self issued credit. You can watch them both (here)

Post your thoughts below.