The decline of the US dollar hegemony is ever so clear today and this article aims to provide the reader with what exactly happened during past periods of reserve currency transitions. Historically, when a reserve currency transitioned over to a new one, it marked a pivotal change for the world. The economic paradigm shifted and the rules of the game changed. This time will be no different when the US dollar loses its status as the reserve currency!

The transition process of the world reserve currency brings much uncertainty

Throughout history, a transition of the reserve currencies has always brought about turmoil and uncertainty in financial markets. One country’s decline, and the subsequent rise of another, marks a radical transformation for the world, especially as market demand shifts. The country that dominates global commerce during any given period is usually marked with the status of having the reserve currency. Spain and Portugal dominated the 15th and 16th centuries, the Netherlands the 17th century, France and Britain the 18th and 19th centuries, and the US dominated the 20th century.

Throughout the Age of Exploration, Portugal created a dominant global empire. Traditional trade routes to Asia were no longer feasible due to the growth of the Ottoman Empire and their 1453 capture of Constantinople, and so the need for alternative trade routes emerged. Thanks to advances in navigational technology as well as other auspicious circumstances, the Portuguese, and soon the Spanish, were to reach Africa, Asia, and the New World. Consequently, the Portuguese and later the Spanish currencies became the primary currencies used in global trade at that time. The Portuguese, throughout their travels and discoveries, established military outposts along the coasts of Africa, India, Malaysia, Japan, and China (Macau), etc.; when they became over-extended, the empire eventually declined due to attacks and competition from other countries (mainly the Dutch, British and French). Portugal and Spain then merged together to create the Iberian union; however, it collapsed through wars and revolutions by the mid-17th century.

It was then the turn of the Dutch, whose rise to global power was largely aided by the creation of the first multinational corporation in the world, the Dutch East India Company (VOC). The Dutch defeated Portugal and Spain in global economic importance and positioned themselves to profit from European demand for spices. By 1669, the VOC was the richest private company that the world had ever seen, with over 150 merchant ships, 40 warships, 50,000 employees, a private army of 10,000 soldiers, and a dividend payment of 40% on the original investment to shareholders. Later, with the event of the Anglo-Dutch War, the spice trade was temporarily ceased and this caused a spike in prices for spices. At that point, other countries were enticed to start their own spice trading companies, namely the French and English (French East India Company and English East India Company). The saturation of the spice market and the costly Anglo-Dutch wars destroyed the Dutch East India Company and their currency (the “Guilder”) as a global currency.

France achieved European political dominance under Louis XIV, and although the legacy of the ‘Roi Soleil’ was great. it is not to be forgotten that he left his heirs in a whirlwind of social strife and extreme debt caused principally by war and an unfair tax base. While the French debt was being allowed to reach staggering amounts, the British, meanwhile, were engaging in an Industrial Revolution that would set Britain apart, creating, in effect, an empire “where the sun never set.” The 1789 French Revolution was essentially a response to a financial crisis that had become debilitating. After a decade of internecine bloodshed and civil war, the French found a new leader under the young general, Napoleon Bonaparte. The Napoleonic Wars of 1803-1815 raged for over a decade, extending French influence over much of Europe (and inspiring a revolution in Haiti). At the height of Napoleon in 1812, the French Empire maintained an extensive military presence in Germany, Italy, Spain, and Poland. It was this Napoleonic empire, however short-lived. that was to rock Europe so profoundly that upon Napoleon’s defeat, the powers of Europe came together to establish a peace at the 1815 Congress of Vienna that would re-balance power for the rest of the 19th century.

Following the defeat of Napoleonic France in 1815, England enjoyed almost a century of global dominance in trade.

By 1922 the British Empire held power over circa 458 million people (one-fifth of the world’s population) and about a quarter of the total land area at the time. By the Second World War, the British Empire was virtually bankrupt. The US provided funding to Britain at the time as they were now the largest creditor nation in the world. However, it was only after the Bretton Woods Conference 1945 that the US dollar officially became the world’s reserve currency.

Each country that rose to ultimate global dominance of commerce declined due to an over-saturation point. Fast-forward to today, and there is a remarkably similar situation for the US. The US has 900 military bases in 130 countries and spent over $640 billion in 2013 on military alone. This figure dwarfs all other military spending combined BY ALL OTHER COUNTRIES. The US is no longer the largest creditor nation in the world, but rather the largest debtor nation in the history of the world. China is now the largest creditor nation. Will the 21th century belong to China and the Yuan?

Today the US dominates the land, sea and air with their overbearing military reach in 130 countries. However, the landscape for war is once again changing. Alternative versions of the traditional warfare are emerging, such as economic/cyber war. By enforcing trade sanctions on a country and manipulating market prices, powerful countries can exert force without even having to step into another country. In other words, the stock market and future’s market have become a tool for the elite. They can drop the price of oil to bankrupt a particular country or sell their national debt on the market to wipe out their currency and create hyper inflation. These measures are much quicker/efficient for government and the elite to employ than the traditional methods of war we have seen in the last century. Although the US dominates the traditional sense of war, they do not have the same type of defense mechanisms in the financial market. As I pointed out in a previous, How the US Dollar Can Collapse, there are virtually an unlimited number of ways the US can be attacked today.

The Typical Duration of a World Reserve Currency

The reserve currency transition is a cycle that has typically lasted in history somewhere between 80 to 110 years. Officially, the US dollar has been the reserve currency for 68 years. However, the US dollar was used in trade much before, since the 1920’s in fact. That would put the US dollar closer to 90+ years as the reserve currency. These cycles of about 100 years (one century) is very common in history: the ancients called it a saeculum which represented four seasons (spring, summer, fall and winter). As with all cycles, there was a period of growth, saturation, peak, and decline which represented these seasons. An excellent book on economic cycles, with a focus on the current cycle in which we find ourselves, is The Fourth Turning by William Strauss and Neil Howe. It is a must-read. Here is a quote from Strauss’s book:

“An appreciation for history is never more important than at times when a secular winter is forecast. In the fourth turning, we can expect to encounter personal and public choices akin to the hardest ever faced by an ancestral generation. We would do well to learn from their experiences, viewed through the prism of cyclical time. This will not come easily. It will require us to lend a new seasonal interpretation to our revered American Dream. And it will require us to admit that our faith in linear progress has often amounted to a Faustian bargain with our children. Faust always ups the ante, and every bet is double or nothing. Through much of the Third Turning, we have managed to postpone the reckoning. But history warns that we can’t defer it beyond the next blend in time.”

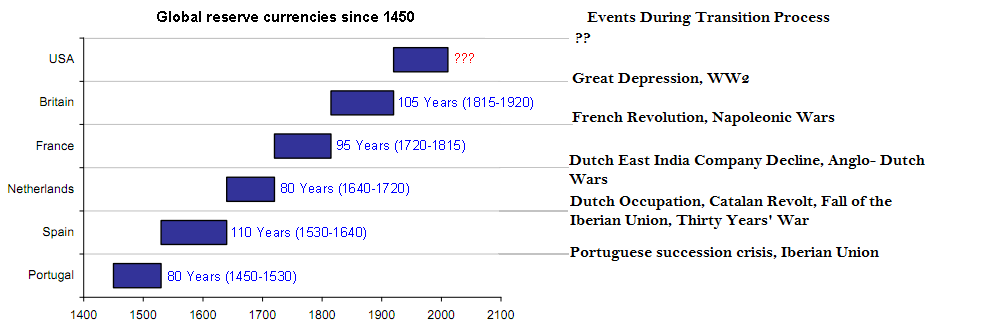

The table below shows the transition of each reserve currencies (every 100 years or so) and the events that were carried out during each transition. Every transition was a period of great suffering marked by economic hardships, revolutions, and wars.

The transition of one World Reserve Currency is a cycle that stems from social behavior

Esteemed British economic historian Arnold Toynbee (1852-1883), in his work Study of History, also identified an “alternating rhythm” of a cycle of war and peace that has occurred in Europe at roughly one-century intervals since the Renaissance. In addition to Europe, Toynbee also identified similar cycles in Chinese and Hellenistic history that averaged 95 years. He linked this to the gradual decay of the “living memory of a previous war,” whereby the descendents of war veterans, for whom their only knowledge of war was through stories, history books, and hearsay, would eventually come into power and resume the belligerent behavior pattern of their forefathers.

The most recent global crisis period was marked by WW1, the Great Depression, and WW2; from the start (1914) to the finish (1945) we find a period that ranges from 100 (1914-2014) to 69 (1945-2014) years ago. This suggests that we may be entering into a new global crisis with the same cyclical thinking.

Global crises wreak havoc on all levels of existence, not to the mention the great cost to human lives. If we are to learn from history, however, it seems as though we might have to nevertheless brace ourselves for yet another one in the near future, as it marks the end of one saeculum and the start of a new economic paradigm aligned more positively with proper balances of trade, debt, and policies.

The US is trying to postpone the crisis by printing money, however this is creating currency wars with nearly all major central banks in the world. As history has shown us time and again, causing this delay through money printing will only aggravate the problem, not only not preventing the inevitable, but indeed making the transition more painful and costly.